Fintech Forward Look 2023

Wrap-Up

Scroll to start.

Fintech Forward Look 2023

Wrap-Up

Scroll to start.

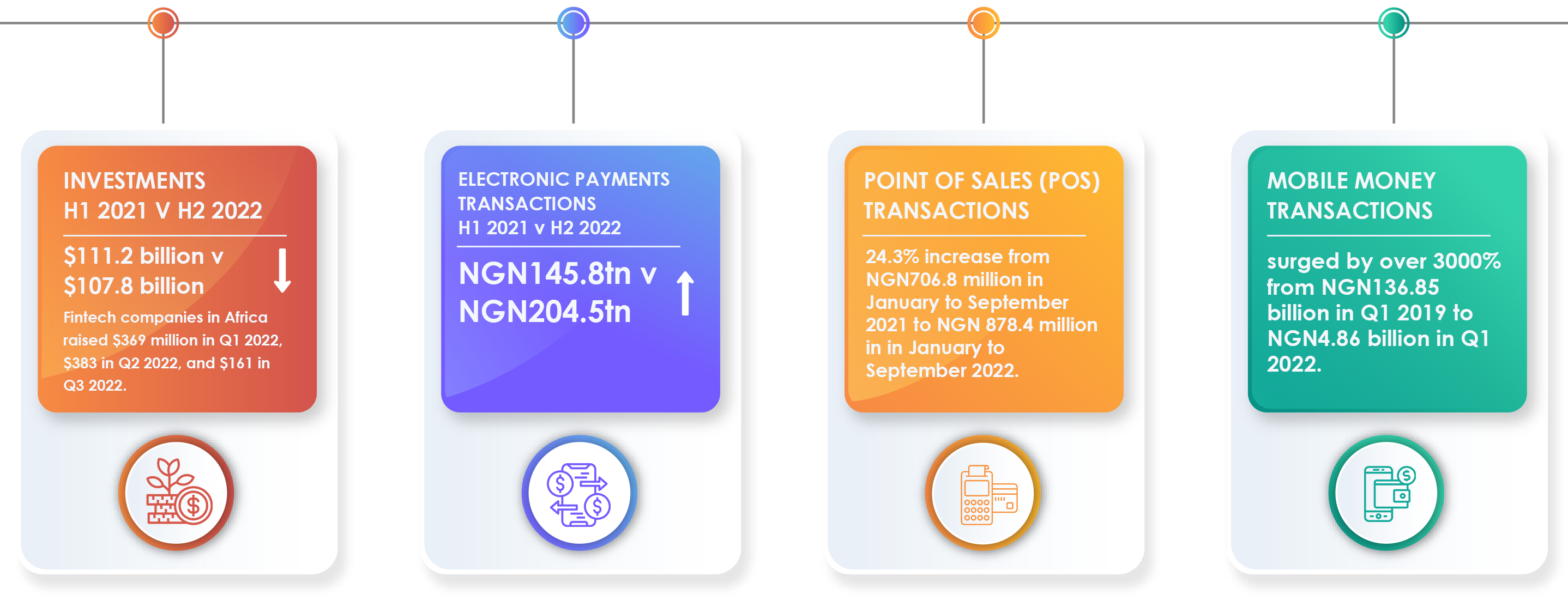

A summary of the key facts and figures in the Fintech ecosystem in 2022.

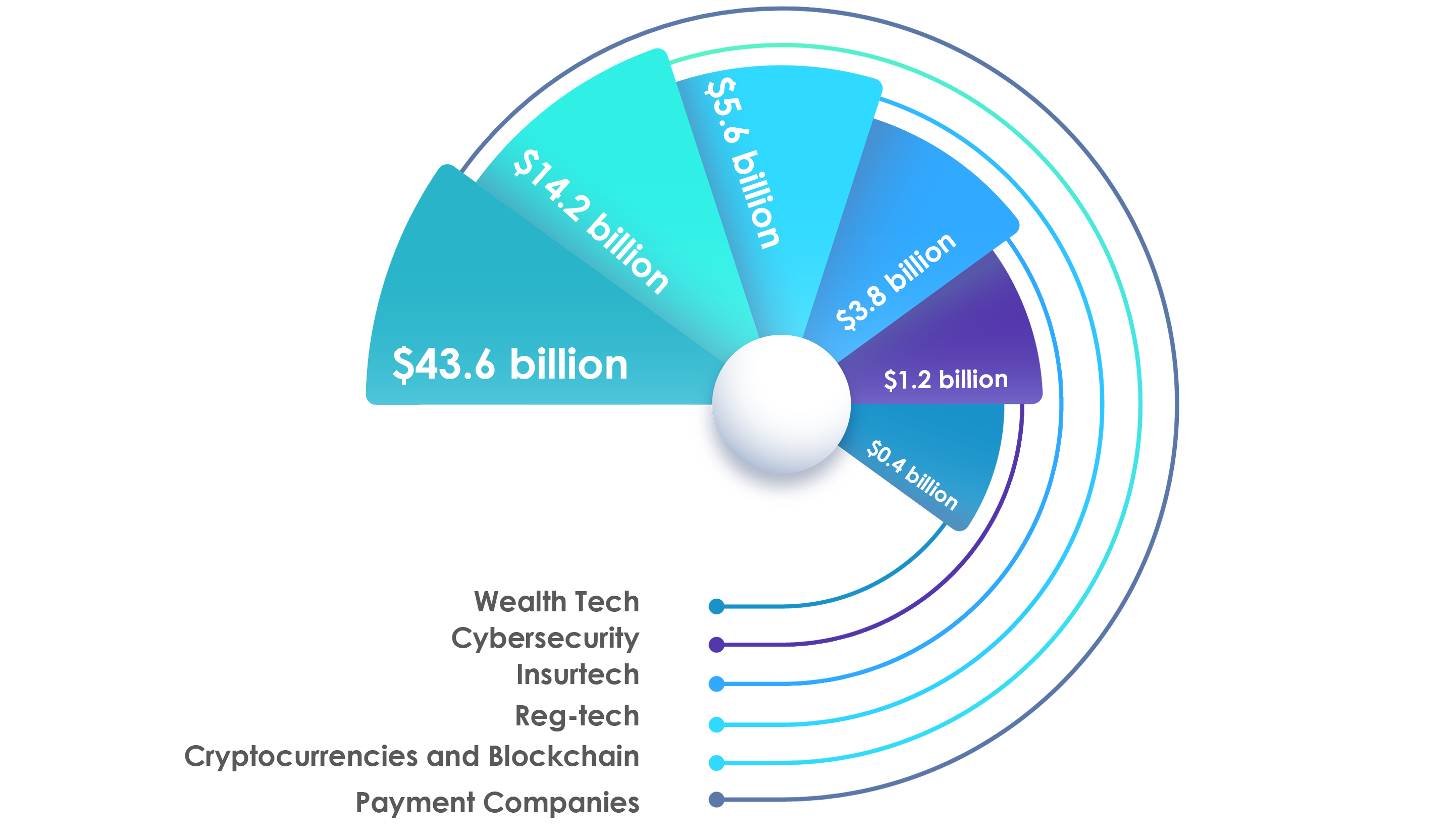

Breakdown of Investments Per Sector H1 2022

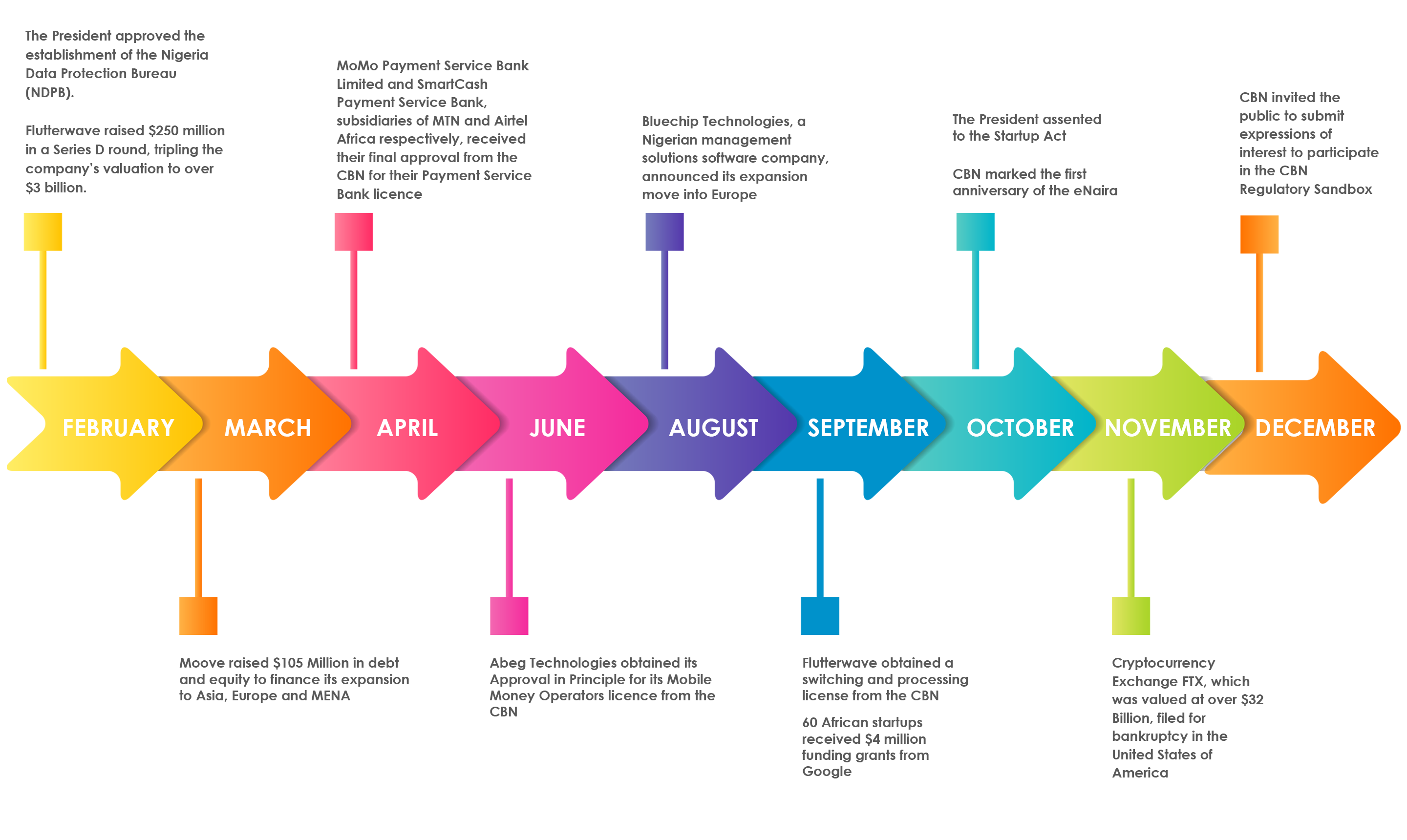

New laws, landmark transactions, new licences and the worldwide cryptocurrency disaster were some of the highlights of 2022 in the Fintech ecosystem, locally and globally. Regulators like the CBN and SEC, as well as NAICOM and FCCPC, issued various regulations and guidelines in reaction to market realities, and to align the regulatory landscape with worldwide best practices.

MNOs descended into the Nigerian Fintech ecosystem in 2022 with the grant of the final approval for PSB licence to SmartCash PSB and MoMo PSB as well as the final super-agent licence to Airtel Mobile Commerce Nigeria Limited. With the grant of these licences, smaller Fintechs that provide the constituent permissible activities of PSBs and agent banks in piecemeal would face fierce competition from these MNO-backed companies.

In 2022, Nigerian regulators began to take a more auspicious approach toward the regulation of cryptocurrency. In H1 2022, SEC issued the Rules on Issuance, Offering Platforms and Custody of Digital Assets (the Rules). The Rules outline the procedures for the registration and operation of entities that provide cryptocurrency and digital assets related services (Participants). The full and effective implementation of the Rules will be dependent on how soon these Participants are able to leverage partnerships with financial institutions.

Mobile money providers are at the forefront of domestic payment services in many emerging markets, including Nigeria. Mobile money transactions in Nigeria increased from NGN136.85 billion in Q1 2019 to NGN4.86 trillion in Q1 2022. Given the domestic growth and success of the mobile money system, mobile money is now regarded as a critical tool for facilitating international remittances due to its ability to lower remittance costs and increase the impact of remittances on development.

Following the release of the Open Banking Framework in 2021, the CBN issued the Draft Operational Guidelines for Open Banking in Nigeria 2022 (the Draft Guidelines). The Draft Guidelines aims to standardize open banking practices in financial industry, making information sharing between participants more streamlined and secure. The approval of the Guidelines is expected to pave the way for enhanced capabilities in areas such as credit risk monitoring, adaptive loan repayment structure for customers, and seamless switching of consumers between financial institutions.

There was significant regulatory activity in the Nigerian digital lending industry in 2022 led by the Federal Competition and Consumer Protection Commission (FCCPC). This involved the FCCPC conducting investigations on digital lenders engaging in unfair practices, seeking court orders to freeze bank accounts of the affected digital lenders, and prohibiting the provision of payments services and telecommunication services to digital lenders under investigation.

African Fintechs are increasingly expanding beyond the borders of their home countries in order to take advantage of untapped markets in other jurisdictions. More than 30 African Fintechs expanded to countries in 2022 through acquisitions of or strategic partnerships with locally licensed entities. The cross-border expansion emphasizes the significance of meeting the regulatory and corporate governance standards of the new host countries, which is one of the challenges Fintechs have faced.

Since last year, an increasing number of African Fintechs have been exploring debt financing as a means to offset the decline in global investor capital and fuel their rapid expansion throughout the continent. Notably, in 2022, African Fintechs (such as Yellow, Moove and MFS Africa) raised over $115 million funding through debt financing.

Outlook for

E-Commerce Heating Up

With 91 million users, Nigeria currently has the highest number of ecommerce users in Africa. This number is projected to increase to about ₦143.9 million by 2027. It is indubitable that for this projection to occur, the Nigerian ecommerce market will have to welcome and accommodate new ecommerce platforms. Amazon Inc is rumoured to begin operations in Nigeria by 2023. Apart from creating more competition for Nigeria’s existing ecommerce platforms and contributing to the growth of the Nigerian ecommerce market, Amazon’s presence will catalyze this projected growth in the number of ecommerce users in Nigeria.

2022 witnessed a larger number of tech companies merging with and acquiring other companies in Nigeria and across Africa. This trend showed that many tech companies are using acquisition to expand their operational scope, market share and circumvent strenuous local and foreign licensing and regulatory requirements when penetrating new markets. It is expected that companies will continue to utilise acquisition to penetrate new markets in 2023 and seek consolidation to manage the drop in funding experienced in 2022.

The year 2022 proved to be challenging for the cryptocurrency ecosystem. The market was dominated by bankruptcy filings by prominent cryptocurrency companies, a drop in the value of major coins, and a general decrease in transaction volumes. The events of the year point to an increasing need to regulate cryptocurrency entities and create legal recourse for investors who have lost money due to cryptocurrency crashes or the bankruptcy of cryptocurrency exchanges.

There was a worldwide decline in venture capital investing across all sectors in 2022. Venture capital funding declined by $90 billion from $191.9 billion in Q4, 2021 to $81 billion in Q3, 2022. Although 2022 was a good year for Africa financially, the third quarter saw a decline in venture capital. Likewise, in Nigeria, no FinTech achieved unicorn status in 2022.

Fintechs are redefining how financial services are provided and traditional banks are reacting to their new competitors by establishing new subsidiaries (such as HabariPay, Hydrogen Payment) that will provide payment solutions services like Fintechs. This is anticipated to be a game-changer in the Fintech ecosystem, since it will likely alter the playing field in favour of traditional banks who may take advantage of their unique position as industry incumbents.

To regulate social media activities in Nigeria, the National Information Technology Development Agency (NITDA) published the Draft Code of Practice for Interactive Computer Service Platforms/Internet Intermediaries (the Code) in June 2022. Although, stakeholders have voiced concerns about the Code that, among other things, it seeks to limit the constitutional rights to freedom of expression and online privacy, it is, however, crucial that control is exercised over unlawful, harmful, and prohibited content.

OLANIWUN AJAYI

“Olaniwun Ajayi has exceptional capabilities in advising on investment transactions and the development of new fintech payment product”

Ranked Band 1 in the Chamber FinTech Guide 2023

Nigerian Fintech Awards 2022, Outstanding Legal Services Award

Ranked Individuals

Damilola Salawu (Partner)

”He has an indepth understanding of not just the rules and regulations governing the Nigerian payment fintech industry, but also of the business nuances. He understands the need to balance innovation with regulation and is very professional and helpful, he listens attentively and is able to marshal his team to provide the support required”

CHAMBERS AND PARTNERS (2022)

“Damilola is a mentor in the space, applauded for his excellent knowledge of the market”

Ranked in Fintech & Blockchain as ‘Global Leader’ and ‘Recommended Lawyer’

Who’s Who Legal 2021

Ranked a Tier 1 practice group by top directories, the Technology, Innovation and FinTech (TIF) practice is a clear leader in the Nigerian legal market. It is led by Damilola Salawu, and the team also comprises, Kofoworola Toriola, Hopewell Nwachukwu, Opeyemi Araromi, Emeka Okpanku, Adenike Adekanmbi, Tayo Fabusiwa, Raphael Irenen, and Eustace Aroh

We remain committed to providing sophisticated legal advice for the full spectrum of players in the technology market.

Click the button below to download the full report. Please send any general comments or feedback to TIF@olaniwunajayi.net.